-

Bank Accounts

-

Financial Assets

-

Loans

-

Mobile Banking

-

Cash transfert services

-

e-tax payments

-

Corporate Current Account

-

Foreign Currency account

We offer support to new and existing small and medium-sized enterprises, tailored to their needs. In order to ensure a customised follow-up, we tailor the current account offer to the needs of every enterprise.

We offer support to new and existing small and medium-sized enterprises, tailored to their needs. In order to ensure a customised follow-up, we tailor the current account offer to the needs of every enterprise.

OUR TARGET

Individual merchants

Partnerships Limited

liability companies

Limited companies

Trusts

BENEFITS

No monthly withdrawal ceiling

OPENING REQUIREMENTS

- Valid proof of registration in the company registry.

- Business licence for the current year

- Taxpayer's card

- Articles of association

- Minutes of the last General Assembly

- Latest financial statements if the business is already operating

- Location map of the company's site

- Minimum initial deposit.

And for every signatory

- A legalized photocopy of the NIC or passport

- One 4x4 photo

- A home location map

- Proof of home address (lease contract or water, electricity, telephone bill, etc.)

- Proof of income (pay slip or other).

If you are an exporter or importer, regularly carrying out transactions in foreign currencies, and you meet Bank Of South Sudan requirements, we can make it easier for you to receive and settle payments by opening an account in the currency of your market.

If you are an exporter or importer, regularly carrying out transactions in foreign currencies, and you meet Bank Of South Sudan requirements, we can make it easier for you to receive and settle payments by opening an account in the currency of your market.

Benefits

Income in foreign currency

Attractive exchange rates

Competitive transfer fees

Preferential fees

Specificities

Accessible to natural persons and legal entities

Mainly a credit account

Authorised transactions: deposits, withdrawals, transfers, etc.

OPENING REQUIREMENTS

Valid proof of registration in the company registry.

Business licence for the current year

Taxpayer's card

Articles of association

Minutes of the last General Assembly

Latest financial statements if the business is already operating

Location map of the company's site

Minimum initial deposit.

And for every signatory

A legalized photocopy of the NIC or passport

One 4x4 photo

A home location map

Proof of home address (lease contract or water, electricity, telephone bill, etc.)

Proof of income (pay slip or other).

-

Term Deposit

-

Financial Engineering

We make it easy for SMEs and large companies to grow their assets. You only have to define how much of your cash you want to invest and then contact us to agree on a rate and term. That's it, you have a safe, interest-bearing, cashless deposit.

We make it easy for SMEs and large companies to grow their assets. You only have to define how much of your cash you want to invest and then contact us to agree on a rate and term. That's it, you have a safe, interest-bearing, cashless deposit.

Benefits

Take advantage of our flexible TD by choosing your own best investment term.

Our TD offers you access an overdraft at a subsidised rate

Our TD is a secure investment, our signature is your guarantee. It offers you the best assurance because it is a zero-capital risk investment.

Our TD is a liquid asset. You can cash it back at any time.

Our financial analyses offer you insight into the market, risk mitigation, product sizing and economic restructuring. Our analyses are renowned for their technical quality and compliance with commercial, accounting and financial regulations.

Our financial analyses offer you insight into the market, risk mitigation, product sizing and economic restructuring. Our analyses are renowned for their technical quality and compliance with commercial, accounting and financial regulations.

We provide support in:

- The structuring and placement of your public offerings on the financial market

- The process of making your securities available to the public until they are booked

- Arranging and financing projects through different financial institutions (banking pool)

Considering your risk profile in the process of building up and monitoring your portfolio of financial assets, we offer you the choice between:

- Free management with complete freedom to choose your investments

- Advisory management to benefit from the advice of our experts while remaining in control of your investment decisions

Management under mandate to enable us to make the best investments on your behalf within the limits of your requirements

-

Investment loans

-

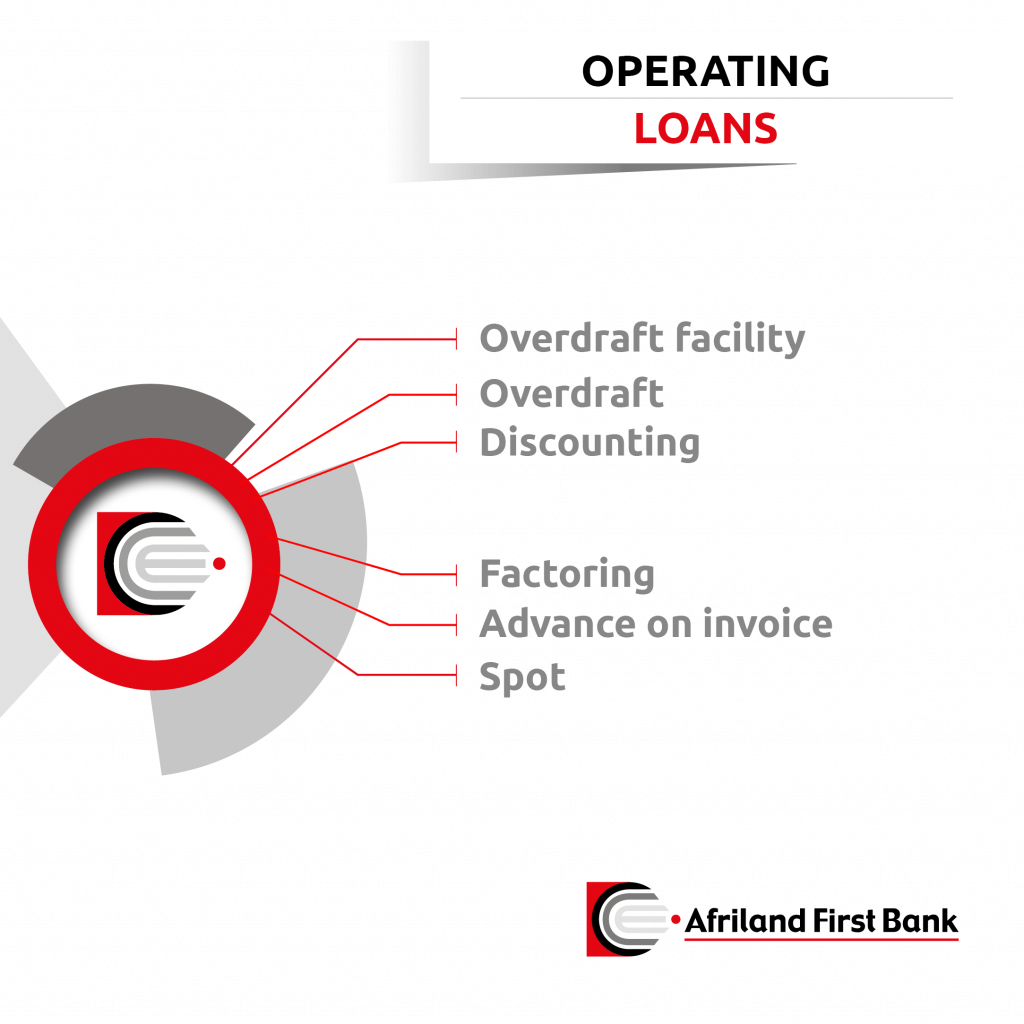

Operating Loans

-

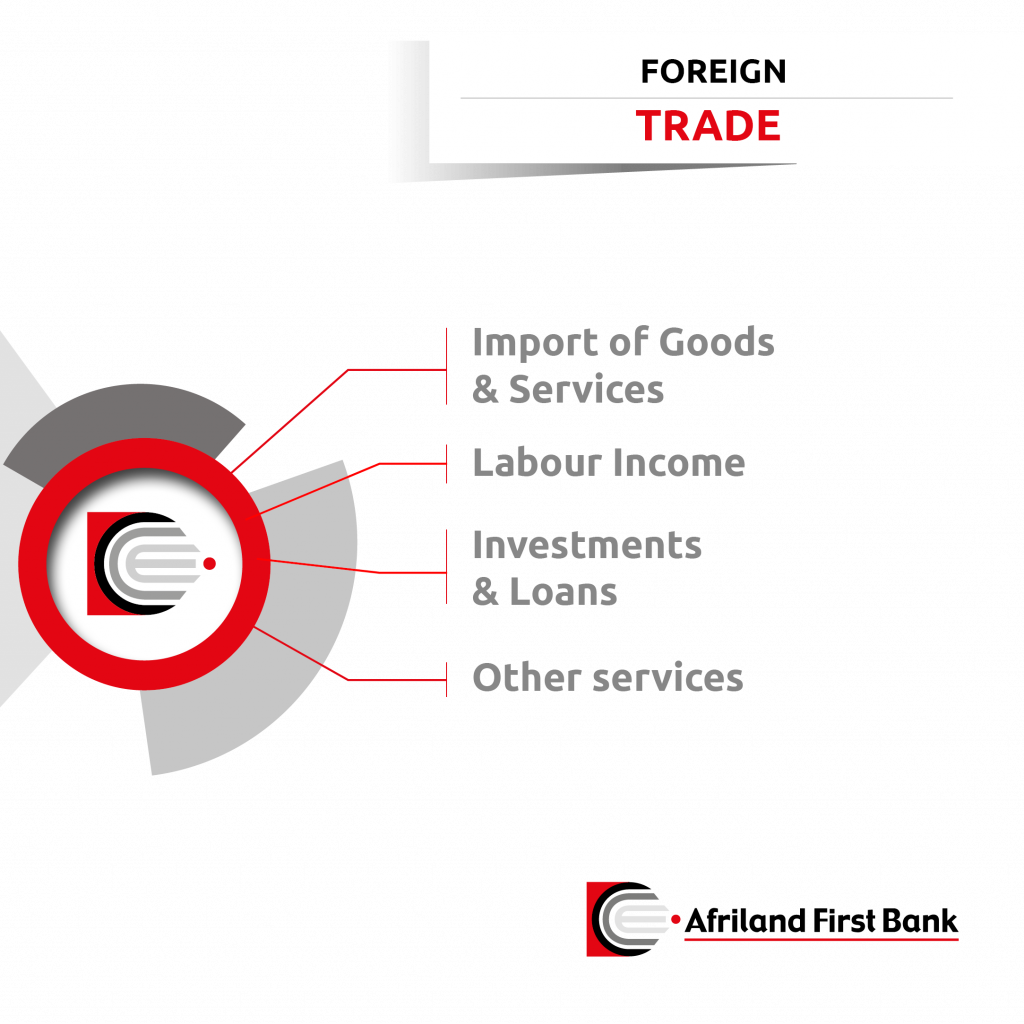

Foreign Trade

SMEs, large companies or even individuals,

SMEs, large companies or even individuals,

You want to start your business?

Enjoy flexible and personalized support.

Afriland First Bank offers you a various range of investment solutions that can go up to 70% of the total financing of your business.

Considering that wealth creation depends mostly on production resources, we can help you acquire your fixed assets: buildings, machines, vehicles, etc.

Our offers:

Medium-term loans: flexible and convenient, this product offers you a repayment capacity ranging from 24 to 60 months, starting from the disbursement of funds.

Long term loans: this product offers you even more flexibility in repayment (24 to 60 months). It is suitable for corporate customers with large investment needs.

Are you facing day-to-day difficulties in running your business? We have designed solutions suitable funning different working capital needs:

Are you facing day-to-day difficulties in running your business? We have designed solutions suitable funning different working capital needs:

- Overdraft facility

- Overdraft

- Discounting

- Factoring

- Advance on invoice

- Spot

You can also take advantage of the flexibility of our repayment terms, which can be spread over up to 24 months. Contact our customer agents and obtain your credit in just 24 hours.

Afriland First Bank South Sudan has a dedicated team to manage your documentary credit, documentary remittance, stand-by letter of credits and all your transfers. Our commitment is to support you until the end of the transaction.

Afriland First Bank South Sudan has a dedicated team to manage your documentary credit, documentary remittance, stand-by letter of credits and all your transfers. Our commitment is to support you until the end of the transaction.

The challenges of the current context: In the wake of the changes resulting from the new foreign exchange regulations and in accordance with our values, our institution is committed to ensuring that our staff spare our customers the risk of compliance. That is why, our approach includes raising customers' awareness on to the risks of sanctions resulting from the new regulations. In order to protect the interests of our customers, we provide them support in the collection and forwarding the requirements for clearance of transfer files (current transfers, Documentary Credit settlements, Documentary Credit settlements).

Please take a look at the leaflets with details of our different trade finance products:

- Import of goods & services

- Labour income

- Investments and loans

- Other services

-

Online Banking and Whastapp Banking

-

Sms First and Whatsapp Banking

-

Bank Conditions

Businesses need the right tools to operate autonomously. With Online Banking, use the Internet to check your account and make bank transfers at any time, without having to go to a branch.

Businesses need the right tools to operate autonomously. With Online Banking, use the Internet to check your account and make bank transfers at any time, without having to go to a branch.

Online banking service is available instantly and on request at our counters.

PASSWORD

The password you choose when you log in for the first time must be made up of 6 digits.

- If you lose or forget your password, you can only obtain a new one from your branch. Do not hesitate to contact your account manager if necessary.

- We recommend that you change your password no later than every 90 days

- For each login attempt, you have a limited number of incorrect entries (3) of your access codes. Beyond this limit, your access to online banking will be blocked. Only your account manager or our customer service can unblock it.

SECURITY

The security of Online banking is ensured by:

- the double key comprising a login and a password

- the encryption of all data circulating on the network (SSL technology).

- Your password is strictly confidential. You can change it at any time. If you forget your password, you can contact your account manager or our customer service department, who are the only ones authorised to create a new password for your use.

With SMS First, you can receive key account information on your mobile phone, even if it's a feature phone, anywhere, anytime. You do not have to be logged on to the internet.

With SMS First, you can receive key account information on your mobile phone, even if it's a feature phone, anywhere, anytime. You do not have to be logged on to the internet.

Subscription

- You can subscribe at any of our branches during working hours, Monday to Friday from 8 am to 11.45am and from 17 pm and on Saturdays from 9 am to 1 pm.

- Fill in and sign the form

- Make sure you indicate the telephone number through which you would like to receive alerts

- Provide a photocopy of your valid identity document (NIC or Passport)

Specifications

Subscribing SMS First entitles you to:

- notifications following any debit or credit transaction in your account

- access to your account balance as many times as you wish

- regular account monitoring: you will receive your account balance every Friday

Benefits

- Service works on all phone models: no need for a Smartphone

- No need for an internet connection to benefit from SMS First

Involves physically moving money from one location to another, specifically directed towards delivering funds to eligible individuals or entities. It facilitates the secure & efficient transfer of financial resources across geographical boundaries, ensuring that recipients receive timely & reliable access to their funds.

Involves physically moving money from one location to another, specifically directed towards delivering funds to eligible individuals or entities. It facilitates the secure & efficient transfer of financial resources across geographical boundaries, ensuring that recipients receive timely & reliable access to their funds.

Ensure compliance with tax payment through our E-Tax Payment Services – where simplicity meets expertise, ensuring your tax obligations are met with ease & confidence.

Ensure compliance with tax payment through our E-Tax Payment Services – where simplicity meets expertise, ensuring your tax obligations are met with ease & confidence.